A recent report says “Templeton Sees Opportunity In Emerging Markets” and here are the reasons why. Franklin Templeton is one of the largest alternative asset management companies in the world.

Franklin Templeton acquired Putnam Investments in the year 2024. This acquisition has added additional capabilities, diversified distribution resources and has established a record of successful investment performance.

Table of Contents

- Recent Virus Outbreak

- Debt in Emerging Market Remains Relatively Low

- Valuations in Attractive Locations

- Improving Cashflows in Emerging Markets

- Risks involved in Investments

Recent Virus Outbreak

A blog post on FranklinTempleton.com states – “Emerging markets have seen progress on back of an uptick in vaccination rollouts, but the recent Chinese regulatory crackdown and further virus outbreaks have caused equities to generally underperform year to date relative to developed markets. With a focus on emerging markets outside of Asia, our Emerging Markets Equity Senior Managing Director Chetan Sehgal nonetheless remains bullish on the long-term potential of emerging markets and outlines three main reasons: debt, valuations and cashflows.”

Debt in Emerging Market Remains Relatively Low

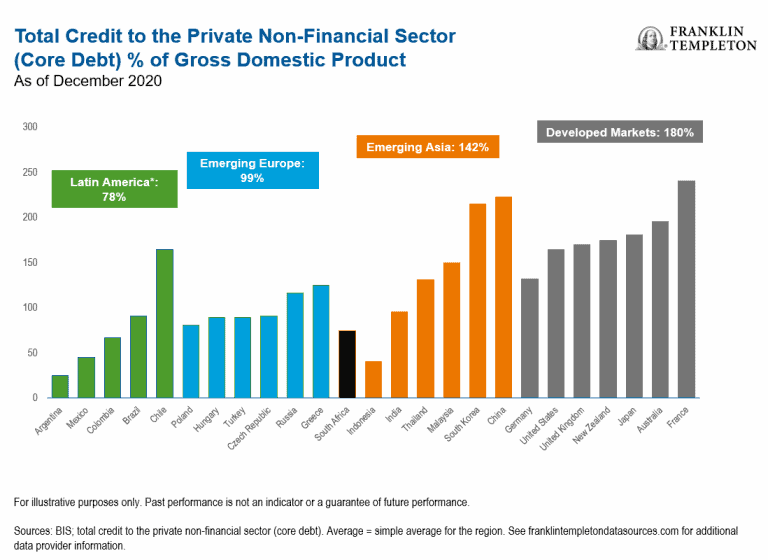

When we look at the emerging market scenario today, one of the most notable trends is the increase in leverage inside economies. Leverage can be a double-edged sword: it can be beneficial while also posing a risk. Over the last decade, debt levels have risen not only in emerging nations, but around the world. COVID-19 has undoubtedly resulted in a significant increase in government debt in some countries, but debt to GDP is now significantly lower in emerging economies than in rich countries—which is one reason for our bullish view.

“Aside from an increase in China, corporate debt, as well as household (consumer) debt levels in emerging markets, are still much lower than in the developed world, too. As such, we feel that emerging markets have much more headroom available to further increase debt levels without a significantly detrimental impact.” – a statement from COVER Web Magazine.

Valuations in Attractive Locations

One of the reasons for bullish view on Emerging markets is that its equities also hold attractive valuations. They trade at a discount to the developed world, despite their high development potential and credit consumption space.

The forward price-to-earnings (P/E) ratio for emerging markets, as assessed by the MSCI Emerging Markets Index, is around 13, while developed companies, as represented by the MSCI World Index, have a forward P/E ratio of around 19.3.

Eastern Europe and Latin America have significantly lower valuations — not only in absolute terms but also in comparison to their own history. Latin America is rich in natural resources and is expected to gain from the commodity boom that is arising as a result of the pandemic recovery. The prices of most commodities have risen, creating a natural tailwind for the economy in those regions, with improved terms of trade being one advantage.

Similarly, Eastern European countries, particularly Russia, are major commodity producers, including nickel and aluminum, and Russia is, of course, a large oil producer. Much of the globe relies on commodities produced in Latin America and Eastern Europe, which should benefit these economies and allied sectors.

Improving Cashflows in Emerging Markets

Cashflows are yet another reason to prefer emerging markets. Over the previous decade, developing economies have underperformed the developed world in terms of return on equity. However, throughout the previous decade, there has been a trend of increasing free cash flows (both in absolute terms and relative to developed markets), which has increased in the recent year.

Emerging market companies are producing significantly more free cash this year as both commodity-oriented and technology-oriented business entities (particularly in the semiconductor industry) have performed well. We anticipate that as cashflows expand, developing market companies will see stronger returns on equity, which will likely fuel a rerating.

Risks involved in Investments

All investments are risky, including the possibility of losing money. The value of assets might fluctuate, and investors may not receive the whole amount deposited. Stock prices change, often swiftly and significantly, due to variables impacting individual companies, certain industries or sectors, or overall market circumstances.

Investing in foreign securities entails special risks, such as those associated with political and economic developments, trading practices, information availability, limited markets, and currency exchange rate fluctuations and policies; investments in emerging markets entail additional risks related to these factors.

For latest stories on Business, Market Updates, Sports, Tech, National and International News, Follow FrontEra News on Facebook, Twitter and Join our FB Community group.

[Illustration Credits: Franklin Templeton]